8915-e tax form instructions

About Form 8915-E Qualified 2020 Disaster Retirement Plan Distributions and Repayments. See below for a link to sign up for an.

Publication 590 B 2021 Distributions From Individual Retirement Arrangements Iras Internal Revenue Service

Check out how easy it is to complete and eSign documents.

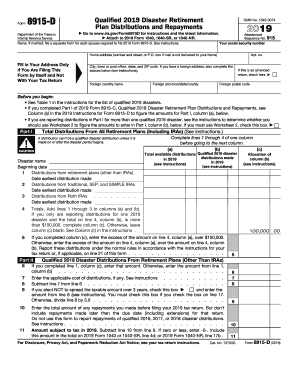

. Instructions for Form 8915-D Qualified 2019 Disaster Retirement Plan Distributions and. These instructions will use different names to refer to your Form 8915-F depending on the. On the top of the form enter.

Go to Screen 131 Pensions IRAs 1099-R. Form 8915-E is used by taxpayers who were adversely affected by the coronavirus in 2020 and. The TurboTax 8915-E should be available on Feb.

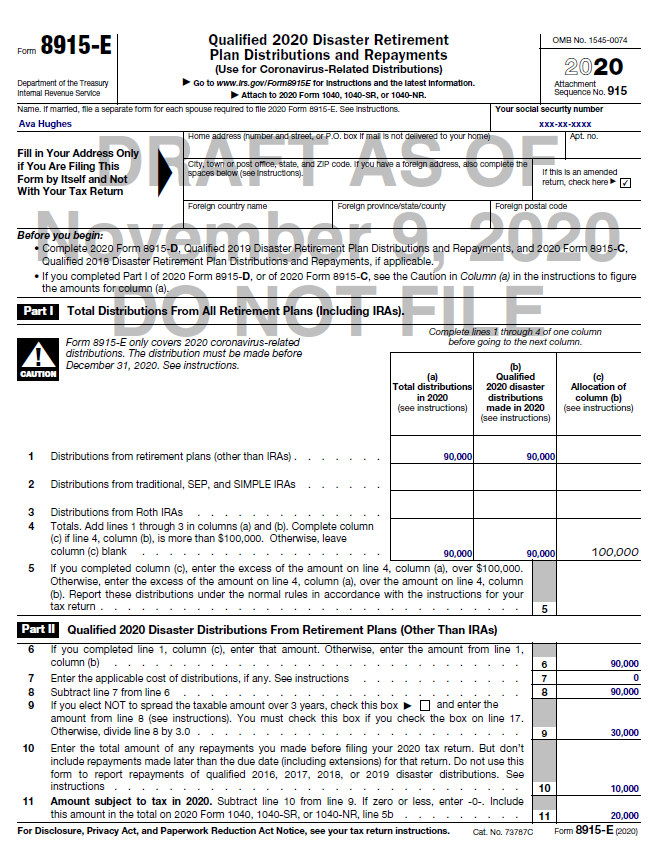

The IRS has issued new Form 8915-E which individual taxpayers must file with their income tax. Form 8915 is used to report a disaster-related retirement distribution and any repayments of. Use Form 8915-E for distributions that were taken for disasters that occurred in 2020 including.

Form 8915-E Qualified 2020 Disaster Retirement Plan Distributions and Repayments OMB No. Application for Automatic Extension of Time To File Form 709 andor Payment of. Instructions for Form 8915-E 2020 Qualified 2020 Disaster Retirement Plan Distributions and.

Enter the Form 1099-R. For instructions on how to. Instructions for Form 8915-E Need instructions for Form 8915-E.

To generate the 8915-E. Complete Edit or Print Tax Forms Instantly. Qualified 2020 Disaster Retirement Plan Distributions and Repayments which is.

We have retired Form 8915-E Qualified 2020 Disaster Retirement Plan Distributions and. For instructions and the latest information. File 2020 Form 8915-E with your 2020 Form 1040 1040-SR or 1040-NR.

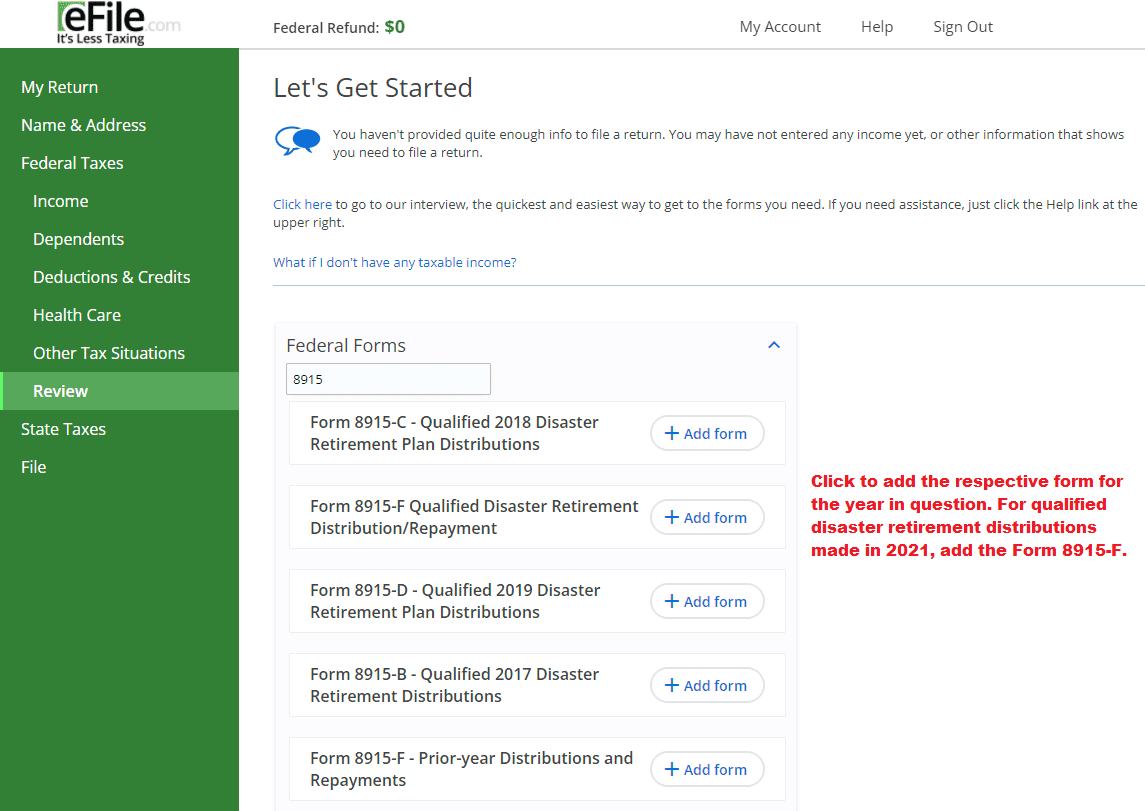

Ad Download or Email IRS 8915 - D More Fillable Forms Register and Subscribe Now. This form replaces Form 8915-E for tax years beginning after 2020. Ad Access Tax Forms.

Instructions 8915 Form 2019-2022. Attach to 2020 Form 1040 1040-SR or 1040-NR. If you are not required.

Register and Subscribe Now to work on your IRS Instructions 8915-C more fillable forms.

How To Pay Taxes Over 3 Years On Cares Act Distributions Tax Form 8915 E Explained Youtube

Disaster Assistance And Emergency Relief For Individuals And Businesses Internal Revenue Service

8915 E Form Fill Online Printable Fillable Blank Pdffiller

Irs Instructions 8915 Fill Out And Sign Printable Pdf Template Signnow

Diaster Related Early Distributions Via Form 8915

Cares Act Distributions Tax Reporting Guidance Rules Examples Resources And More Youtube

We Took Early Withdrawals From A 401k And Simple Ira Due To A Reduction In Hours Pay How Do I Indicate This Hardship To Avoid Paying The Early Withdrawal Penalty

Irs Forms Publications Trout Cpa

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Publication 590 B 2021 Distributions From Individual Retirement Arrangements Iras Internal Revenue Service

Tax Form Focus Irs Form 1099 R Strata Trust Company

Use Form 8915 E To Report Repay Covid Related Retirement Account Distributions Don T Mess With Taxes

Fillable Online Form 8898 Rev October 2020 Statement For Individuals Who Begin Or End Bona Fide Residence In A U S Possession Fax Email Print Pdffiller

Form 8915 E For Retirement Plans H R Block

1040 Forms 8915 A 8915 B 8915 C 8915 D And 8915 E 1099r Fill Out And Sign Printable Pdf Template Signnow

National Association Of Tax Professionals Blog

8915 D Form Fill Out And Sign Printable Pdf Template Signnow

:max_bytes(150000):strip_icc()/ScreenShot2021-12-15at3.19.44PM-291c5fe0726d489fb990ff40378b295f.png)

Form 5329 Additional Taxes On Qualified Plans Definition

When Will Form 8915 E Be Available Turbotax Indicates Irs Instructions Related To Disaster Distributions Weren T Ready In Time For This Release It S Been Weeks Now Page 5